stamp duty malaysia calculation

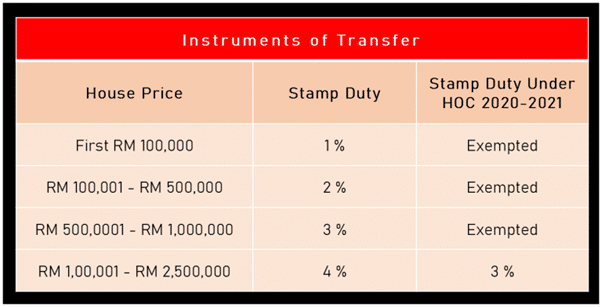

The stamp duty fee for the remaining amount will be 300000. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid First RM100000 x 1 Next RM400000 x 2 05 of loan.

Rental Agreement Stamp Duty Malaysia Speedhome

The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by Sabahs law.

. To calculate the amount you need to pay for the stamp of your rental agreement enter your monthly rental and rental period in the computer below. Stamp Duty Loan Calculation Formula The Property Price must be less than RM500000. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

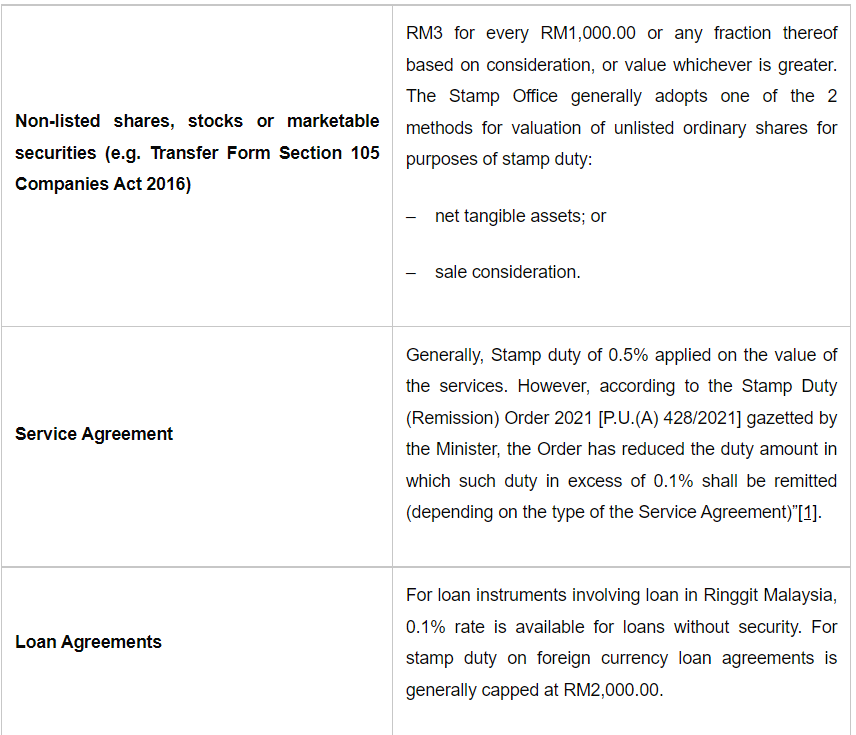

The stamp duty of the loan. Manual Calculation Formulae as below or you can use the above Tenancy Agreement Stamp Duty Calculator Malaysia to help you calculate Malaysia Rental Stamp Duty Calculator For Example. Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments.

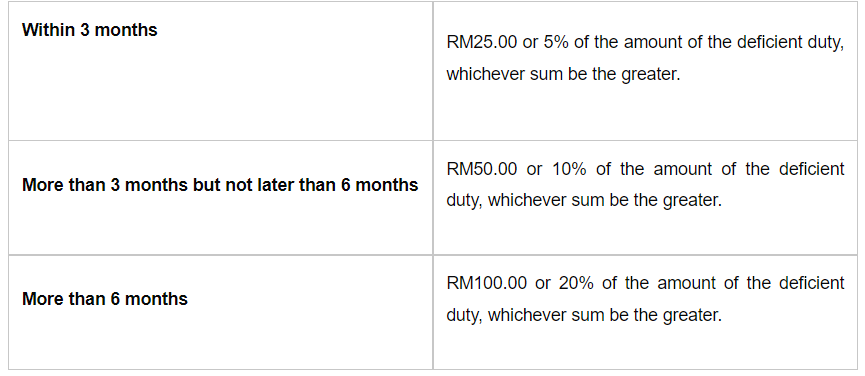

Please note that the above formula merely provides estimated stamp duty. The actual stamp duty will be rounded up according to the. Luckily Malaysia Realtors created a handy Legal Fee and Stamp Duty.

- Stamp duty exemption is capped at RM300000 on the property market value and loan amount. Calculate now and get free quotation. Here are the stamp duty fee according to the property price.

Its actually quite simple to calculate Loan Agreement Stamp Duty. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Stamp Duty Exemption Calculation The First Example If the property Purchase Price or Property value is RM300000 the property stamp duty will be as follows.

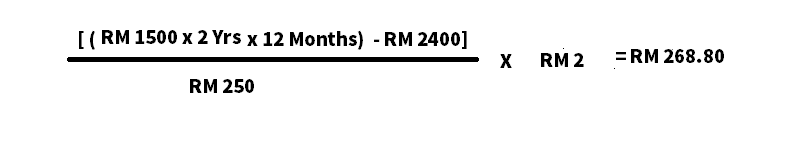

Stamp duty is a tax on legal documents in Malaysia. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Stamp Duty on MOT Stamp Duty on Home Loan First RM100000 x 1 Next RM400000 x 2 Remaining RM100000 x 3.

Both the stamp duty for the SPA and the MOT are calculated based on the purchase price Refer below to 18 for the price tiers. LEGAL FEE STAMP DUTY FOR SPA AGREEMENT LOAN Calculating your legal fees and stamp duty can be confusing. FORMULA Loan Sum x 05.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. The detailed calculation as follows. Do I need to pay stamp duty.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Your total stamp duty would be. An example for the calculation of stamp duty of shares is that for.

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan. You can pay stamp duty to. The stamp duty is based on the purchase price of the property.

There are no scale fees its a flat rate of 050 from the Total Loan Amount. Stamp Duty Exemption Calculation The First Example If the property Purchase Price or Property value is RM300000 the property stamp duty will be as follows. How is stamp duty calculated.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as. For Example If the loan amount. The 2020 Guidelines indicate that the stamp duty will be imposed on the value of shares rounded up to the nearest thousand.

Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid First RM100000 x 1 Next. The following powerful calculator is designed for public to estimate the legal fees and stamp.

Malaysian Tax Law Stamp Duty Lexology

How To Calculate Stamp Duty For Tenancy Agreement How To Calculate Stamp Duty For Tenancy Agreement Original Video Https Youtu Be 1g9sscemjha Please Subscribe Share Our Youtube Channel For More

Malaysian Tax Law Stamp Duty Lexology

Drafting And Stamping Tenancy Agreement

Solved Question 4 Malaysia Tax A Mr James Purchased A Piece Of Land And Signed An Agreement For Its Purchase On 14 July 2016 At An Agreed Price Of Course Hero

Ws Genesis E Stamping Services

Peps Malaysia Stamp Duty Calculation Follow Peps Malaysia Facebook Page To Get Experts Insights On Property In Malaysia Stampdutymalaysia Pepsmalaysia Propertytaxmalaysia Facebook

Hqdefault Jpg Sqp Oaymwejcpybeiobsfryq4qpaxuiaruaaaaagaelaadiqj0agkjdeae Rs Aon4clcsiq8mvu4qf2l24adcofvwgriiia

Home Loan Calculator Malaysia Stamp Duty Legal Fee Valuation Fee 2022 Property Malaysia

Home Ownership Campaign Hoc 2021 Properly

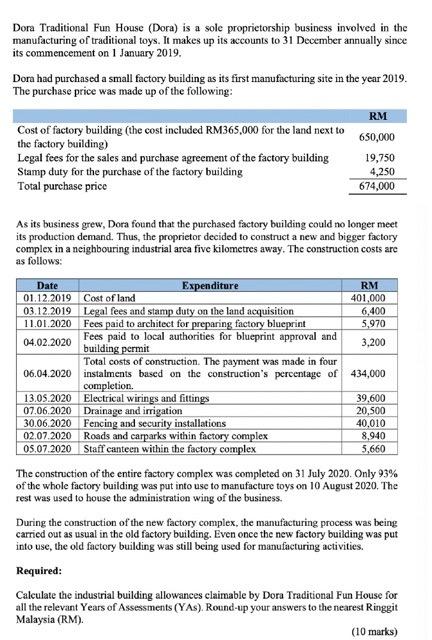

Dora Traditional Fun House Dora Is A Sole Chegg Com

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2022

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Faqs Perfection Of Transfer And Charge Publication By Hhq Law Firm In Kl Malaysia

Home Loan Calculator Malaysia Stamp Duty Legal Fee Valuation Fee 2022 Property Malaysia

Comments

Post a Comment